…send their child to a private school that he/she already attends.

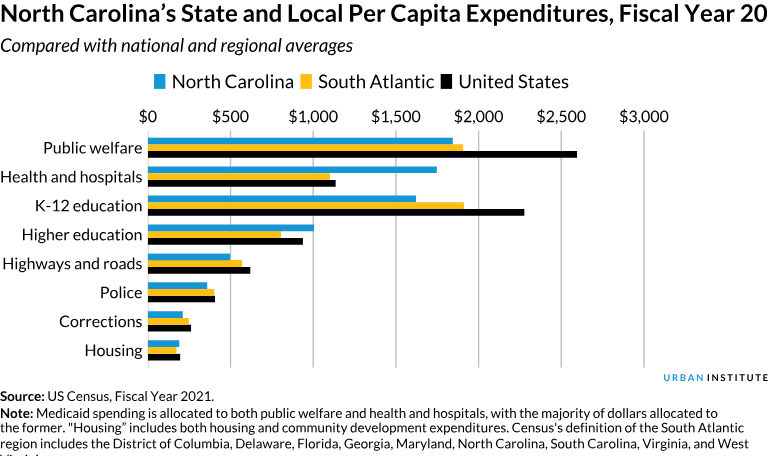

According to the Tax Foundation, the average per capita state and local tax collection for North Carolina is under $5,000.

That’s well below the highest amount allowed for a voucher for a single student.

That’s for anyone.

Your state and local taxes go to vital needs like public welfare, transportation, an educated citizenry, healthcare, and safety.

But imagine if none of your state taxes went to those constitutionally designated endeavors; rather, all of the taxes you paid as a working citizen (plus money from another person) could go to a family who has one person under that roof who makes more money than you do. That family then uses that money to send a child to a religiously aligned private school that does not undergo near as much scrutiny as a public school.

Some might say that private schools provide a better education. Then prove that those schools that accept voucher money are better – same standardized tests, oversight, and other valuie-added measures.

Some might claim that its “their money already.” Not really. It’s every North Carolinian’s money. If North Carolina wants to give some families more money than they pay in local and state taxes to attend schools sponsored by already tax-exempt entities, then put it on the ballot.